Karora Resources owns 100% of the Beta Hunt Mine, a producing gold mine located in the prolific Kambalda mining district of Australia.

The underground Beta Hunt Mine, located 600 km from Perth in Kambalda, Western Australia, is a deposit with the very rare feature of hosting both gold and nickel resources in adjacent discrete mineralized zones. The mining tenements on which the Beta Hunt Mine is located are held by Gold Fields Limited. Karora Resources operates the Beta Hunt Mine by virtue of a sub-lease agreement with Gold Fields Limited.

The Kambalda mining district in Western Australia is a long-established major mining centre with excellent existing infrastructure, a skilled local workforce, and nickel and gold processing mills nearby. Beta Hunt was originally developed and operated by Western Mining Corporation (WMC) in the 1970's and the mine was sold to Gold Fields in 2001. In 2003, Reliance Mining Limited (RML) acquired the nickel rights and resumed production.

Consolidated Minerals Limited acquired RML in 2005 and invested in both increasing resources and expanding production. The mine operated continuously until the end of 2008, when it was placed on care and maintenance due to the financial crisis and associated collapse in metal prices.

Transactions during the period 2001 - 2003 resulted in the separation of nickel rights from the gold rights. Salt Lake Mining subsequently acquired the property in 2013 and succeeded in re-combining the nickel and gold rights. Nickel operations were re-started in 2014. Initial gold production occurred in June to July 2014 then ceased and recommenced at the end of 2015. The mine has been in continuous operation since then. Karora Resources acquired 100% of SLM in 2016 under its previous business name RNC Minerals. The main gold production areas are currently Western Flanks and A Zone.

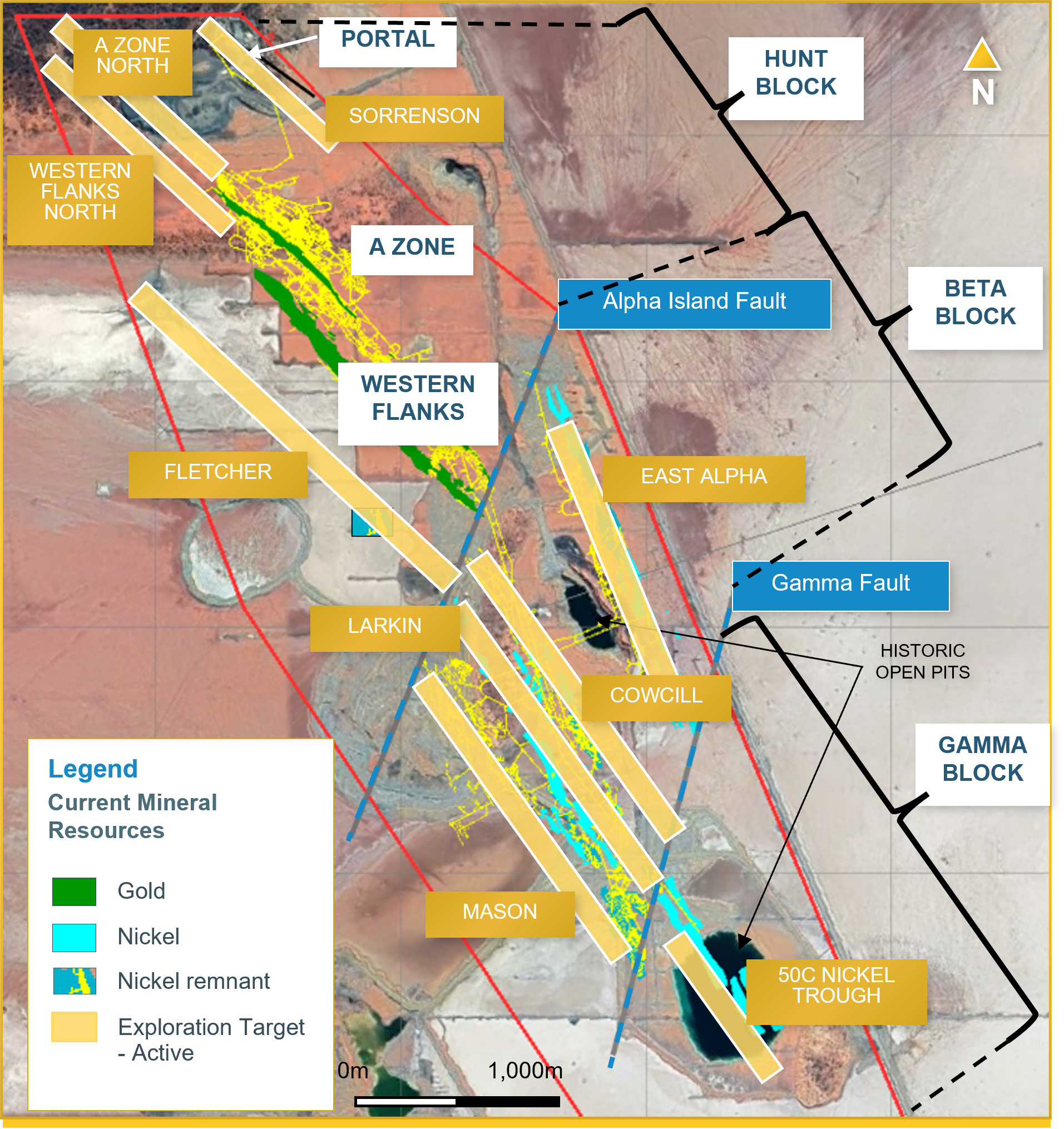

The Beta Hunt land package includes significant exploration opportunities at Beta Hunt to add to the Mineral Resources alongside production. There are numerous gold zones at Beta Hunt, including Western Flanks, A Zone, Larkin, East Alpha and Fletcher – providing significant potential for gold Mineral Resource expansion at low cost and near mine infrastructure. There are also new nickel zone discoveries - 50C Nickel Trough in the Gamma Block and 30C Nickel Trough in the Beta Block - providing significant ongoing potential for nickel Mineral Resource expansion and increased by-product credits.

Beta Hunt is situated within the central portion of the Norseman-Wiluna greenstone belt in a sequence of mafic/ultramafic and felsic rocks on the southwest flank of the Kambalda Dome. Gold mineralization occurs mainly in subvertical shear zones in the Lunnon Basalt and is characterized by shear and extensional quartz veining within a halo of biotite/pyrite alteration. Within these shear zones, coarse gold sometimes occurs where the shear zones intersect iron-rich sulphidic metasediments in the Lunnon Basalt or nickel sulphides at the base of the Kambalda Komatiite (ultramafics).

Nickel mineralization is hosted mainly by talc-carbonate and serpentine altered ultramafic rocks (Kambalda Komatiite) that overlie the Lunnon Basalt. The primary sulphide minerals are typically pyrrhotite > pentlandite > pyrite with trace chalcopyrite.

|

The Beta Hunt Mine is owner-operated using conventional underground mining methods. Current operating capacity is approximately 1.0 Mtpa of mined material transported through a single decline. An expansion to double capacity to approximately 2.0 Mtpa through the construction of a second decline and associated infrastructure, including increased ventilation capacity, commenced in the first quarter of 2022. The second decline portion of the expansion was completed in the first quarter of 2023.

All gold processing is conducted at Karora’s Higginsville and Lakewood mills. Nickel mineralization is trucked and toll treated at a third-party toll mill in the Kalgoorlie area.

Technical Report Beta Hunt Operation Eastern Goldfields, Western Australia

Beta Hunt Gold Mineral Resource as at September 30, 2023

| Mineral Resource | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sept - 2023 | Kt | g/t | Koz | Kt | g/t | Koz | Kt | g/t | Koz | Kt | g/t | Koz |

| Western Flanks | 859 | 2.9 | 79 | 10,436 | 2.9 | 980 | 11,295 | 2.9 | 1,059 | 6,364 | 2.9 | 587 |

| A Zone | 419 | 2.7 | 37 | 4,143 | 2.4 | 317 | 4,563 | 2.4 | 354 | 3927 | 2.3 | 296 |

| Larkin | - | - | - | 2,028 | 2.6 | 168 | 2,028 | 2.6 | 168 | 1,761 | 2.4 | 134 |

| Mason | - | - | - | - | - | - | - | 0.0 | - | 778 | 2.7 | 67 |

| Cowcill | - | - | - | 248 | 2.4 | 19 | 248 | 2.4 | 19 | 35 | 2.9 | 3 |

| Total | 1,278 | 2.8 | 116 | 16,855 | 2.7 | 1,484 | 18,133 | 2.7 | 1,600 | 12,865 | 2.6 | 1,086 |

Beta Hunt Gold Mineral Reserve as at September 30, 2023

| Mineral Reserve | Proven | Probable | Proven & Probable | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Sept - 2023 | Tonnes kt |

Grade g/t |

Ounces koz |

Tonnes kt |

Grade g/t |

Ounces koz |

Tonnes kt |

Grade g/t |

Ounces koz |

| Western Flanks | 198 | 2.4 | 15 | 4,340 | 2.8 | 390 | 4,538 | 2.8 | 405 |

| A Zone | 118 | 3.3 | 13 | 1,107 | 2.4 | 86 | 1,225 | 2.8 | 99 |

| Larkin | - | - | - | 814 | 2.6 | 69 | 814 | 2.6 | 69 |

| Total | 316 | 2.7 | 28 | 6,260 | 2.7 | 545 | 6,577 | 2.7 | 573 |

| Mineral Resource | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sept-2023 | Kt | % Ni | Nits | Kt | %Ni | Nits | Kt | % Ni | Nits | Kt | % Ni | Nits |

| Beta Block | - | - | - | 579 | 2.8% | 16,400 | 579 | 2.8% | 16,400 | 182 | 2.8% | 5,200 |

| Gamma Block | - | - | - | 197 | 3.0% | 6,000 | 197 | 3.0% | 6,000 | 317 | 2.6% | 8,200 |

| Total | - | - | - | 776 | 2.9% | 22,300 | 776 | 2.9% | 22,300 | 500 | 2.7% | 13,400 |

Detailed Footnotes relating to Mineral Resource Estimates as at September 30,2023

Detailed Footnotes relating to Mineral Reserve Estimates as at September 30, 2023

Straight from our desk, to your inbox.

Subscribe To Our News Releases

© All rights reserved Karora Resources 2024