TORONTO, March 7, 2016 /CNW/ - Royal Nickel Corporation ("RNC") (TSX: RNX) Announces that, further to its news release of February 1, 2016, the Beta Hunt Mine preliminary economic assessment ("PEA"), prepared as a NI 43-101 compliant technical has been filed under RNC's profile on SEDAR at www.sedar.com and on RNC's website at www.royalnickel.com.

On February 1, 2016 RNC announced it reached an agreement to acquire a 67% interest in Salt Lake Mining Pty Ltd. ("SLM"), including the 20% interest acquired on February 1, 2016. The remaining portion of the transaction is expected to close in March 2016. SLM's main asset is a 100% interest in the Beta Hunt Mine.

"The PEA highlights the robust economics and free cash flow potential of the Beta Hunt Mine. I look forward to the rapid ramp-up of gold production at Beta Hunt during 2016 and advancing the excellent exploration potential to add to the resource base," said Mark Selby, President and CEO of RNC.

Highlights of the Beta Hunt PEA:

|

1. Figures are at asset level and do not include repayment of existing debt facility. March 4, 2016 CDN$/US$ exchange rate was 1.334. |

Beta Hunt Mine PEA Summary

The Beta Hunt Mine, located 600 km from Perth in Kambalda, Western Australia, is a deposit with the very rare feature of hosting both nickel and gold resources in adjacent discrete mineralized zones. The mining tenements on which the Beta Hunt Mine is located are held by Gold Fields Limited. SLM operates the Beta Hunt Mine by virtue of a sub-lease agreement with Gold Fields Limited.

Beta Hunt Mine (100% Basis) Summary

Table 1: PEA Base Case Operating Summary

|

Item |

Units |

Total |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Nickel Mineralization1 |

000 tonnes |

572 |

143 |

156 |

152 |

121 |

0 |

|

Nickel Grade1 |

% Ni |

2.42 |

2.75 |

2.55 |

2.37 |

1.94 |

0.00 |

|

Contained Nickel |

000 lbs |

30,556 |

8,675 |

8,782 |

7,951 |

5,149 |

0 |

|

Gold Mineralization1 |

000 tonnes |

2,924 |

425 |

600 |

600 |

600 |

495 |

|

Gold Grade1 |

g/t Au |

3.06 |

3.30 |

3.07 |

2.76 |

3.16 |

3.01 |

|

Contained Gold |

000 oz |

287 |

45 |

59 |

53 |

61 |

48 |

|

1. |

Diluted tonnes and grade |

Table 2: PEA Base Case Economic Summary (see table 6 for key assumptions)1,2,3

|

Item |

Units |

Total |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Net C1 Cash Costs – Ni in conc |

US$ / lb Ni |

(2.70) |

(0.86) |

(1.60) |

(1.04) |

(3.77) |

n/a |

|

Net AISC4 – Ni in conc |

US$ / lb Ni |

0.28 |

0.59 |

0.44 |

1.28 |

0.20 |

n/a |

|

Co-Product AISC4 – Ni in conc |

US$ / lb Ni |

2.87 |

2.37 |

2.66 |

3.16 |

3.65 |

n/a |

|

Net C1 Cash Costs – Au |

US$ / oz Au |

529 |

513 |

447 |

412 |

542 |

680 |

|

Net AISC4 - Au |

US$ / oz Au |

825 |

775 |

732 |

735 |

843 |

953 |

|

Co-Product AISC4 - Au |

US$ / oz Au |

893 |

826 |

841 |

889 |

889 |

953 |

|

EBITDA |

US$ millions |

134.5 |

21.5 |

31.9 |

29.5 |

27.7 |

17.1 |

|

Free Cash Flow (before debt repayment) |

US$ millions |

80.4 |

6.4 |

16.6 |

20.8 |

19.2 |

12.5 |

|

1. |

Cash operating costs and cash operating cost per tonne sold are non-IFRS measures. In the nickel mining industry, cash operating costs and cash operating costs per tonne are common performance measures but do not have any standardized meaning. Cash operating costs are derived from amounts included in the Consolidated Statements of Comprehensive Income (Loss) and include mine site operating costs such as mining, processing and administration as well as royalty expenses, but exclude depreciation, depletion and share-based payment expenses and reclamation costs. Cash operating costs per tonne are based on tonnes sold and are calculated by dividing cash operating costs by commercial nickel tonnes sold; US$ cash operating costs per tonne sold. SLM prepares this information as it believes the measures provide valuable assistance to investors and analysts in its operational performance and ability to generate cash flow. The most directly comparable measure prepared in accordance with IFRS is total production costs. | |

|

2. |

All-in sustaining costs and all-in sustaining cost per tonne sold are non-IFRS measures. These measures are intended to assist readers in evaluating the total costs of producing nickel from current operations. SLM defines all-in sustaining costs as the sum of production costs, sustaining capital (capital required to maintain current operations at existing levels), corporate general and administrative expenses, in-mine exploration expenses and reclamation cost accretion related to current operations. All-in sustaining costs exclude growth capital, growth exploration expenses, reclamation cost accretion not related to current operations, interest and other financing costs and taxes. The most directly comparable measure prepared in accordance with IFRS is total production costs. | |

|

3. |

The technical information in this table has been prepared in accordance with Canadian regulatory requirements by, or under the supervision of David Penswick, P.Eng. | |

|

4. |

AISC: All-in sustaining cost includes site costs, off-site costs, royalties, and sustaining capital |

Table 3: Beta Hunt Economic Sensitivity Metrics

|

Variation from Base Case |

Base Case |

Variation from Base Case | ||||||

|

Nickel |

Gold |

A$ f/x |

Nickel |

Gold |

A$ f/x | |||

|

Metric |

units |

-$1.00/lb |

-$100/oz |

-US$0.01 |

+$1.00/lb |

+$100/oz |

+US$0.01 | |

|

NPV 5% |

US$ M |

($10) |

($15) |

$2 |

$70 |

$11 |

$15 |

($2) |

|

NPV 8% |

US$ M |

($10) |

($14) |

$2 |

$65 |

$10 |

$14 |

($2) |

|

Net Ni C1 Cash Cost |

US$/lb Ni |

$0.00 |

$1.01 |

($0.12) |

($2.70) |

$0.00 |

($1.01) |

$0.12 |

|

Net Au C1 Cash Cost |

US$/oz Au |

$64 |

$0 |

($12) |

$529 |

($65) |

$0 |

$12 |

|

Co-Product Ni AISC |

US$/lb Ni |

($0.16) |

$0.02 |

($0.03) |

$2.87 |

$0.16 |

($0.01) |

$0.03 |

|

Co-Product Au AISC |

US$/oz Au |

$7 |

($11) |

($11) |

$893 |

($7) |

$11 |

$11 |

Cautionary Statement: The decision by SLM to produce at the Beta Hunt mine was not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on SLM's cash flow and future profitability. It is further cautioned that the PEA is preliminary in nature. No mining feasibility study has been completed on Beta Hunt. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that the PEA will be realized.

Table 4 Beta Hunt Nickel Mineral Resources as at February 1, 20161,2,3,5

|

Nickel |

Classification |

Inventory (kt) |

Grade (Ni %) |

Contained Metal Nickel Tonnes (NiTs) |

|

>=1% Ni |

Measured Indicated |

96 283 |

4.6 4.0 |

4,460 11,380 |

|

Total |

379 |

4.2 |

15,840 | |

|

Inferred |

216 |

3.4 |

7,400 |

Table 5: Beta Hunt Gold Mineral Resources as at February 1, 20161,2,4,5

|

Gold |

Classification |

Inventory (kt) |

Grade (Au g/t) |

Contained Metal (Ounces) |

|

>=1.8 g/t Au |

Measured Indicated |

0 815 |

0.0 3.5 |

0 92,000 |

|

Total |

815 |

3.5 |

92,000 | |

|

Inferred |

2,910 |

3.4 |

321,000 |

|

1. |

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. | |

|

2. |

The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied. Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding | |

|

3. |

Nickel Mineral Resources are reported using a 1% Ni cut-off grade | |

|

4. |

Gold Mineral Resources are reported using a 1.8 g/t Au cut-off grade | |

|

5. |

Mineral Resources described here has been prepared by Elizabeth Haren, MAusIMM CPGeo, of Haren Consulting Pty Ltd. |

Mineral resources at Beta Hunt are lower than previously disclosed in RNC's news release dated February 1, 2016 mainly due to depletion occurring since the date of the previous resource estimate (May 1, 2015) to the date of the updated estimate, February 1, 2016.

Table 6: Key Assumptions

|

Item |

Units |

2016 |

2017 |

2018 |

2019+ |

|

Nickel Price |

US$/lb |

4.00 |

5.25 |

6.50 |

6.50 |

|

Gold Price |

US$/oz |

1,150 |

1,150 |

1,150 |

1,150 |

|

A$ f/x |

US$ |

0.72 |

0.72 |

0.72 |

0.72 |

Base case assumptions include a continuation of the nickel operation at current production rates of approximately 13 kt per month until depletion of mineable resources. It is also assumed that gold operations will ramp up to a steady-state rate of 50 kt per month, then maintain this rate until depletion of mineable resources.

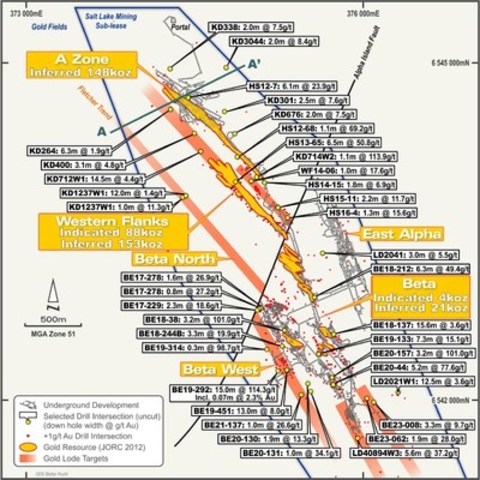

Exploration Potential

The exploration potential of Beta Hunt is significant as a number of nickel and gold occurrences have been intersected outside the current resources. These include occurrences both along the immediate trends of current resources and along poorly explored parallel trends as illustrated below in figure 1.

NI 43-101 Compliance

With respect to the SLM acquisition, the technical information in this news release has been prepared in accordance with Canadian regulatory requirements by, or under the supervision of David Penswick, P.Eng.; and Elizabeth Haren, MAusIMM CPGeo, of Haren Consulting Pty Ltd., all of whom are independent Qualified Persons as set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

Quality Assurance - Quality Control ("QA/QC") at Beta Hunt

The majority of the nickel Mineral Resources reported has been defined by drill holes completed in 2008 and 2014 while the gold Mineral Resources have been generated from drill holes completed over the life of the Beta Hunt mine. Sampling and assaying methodologies have been tailored to either nickel or gold depending on the drill target.

All diamond core samples have been analyzed by external laboratories with various levels of company based and laboratory internal QA/QC programs implemented. Some quality issues have been identified over time however the Qualified Person does not consider the overall effect of minor errors to be material to the reported Mineral Resources. This is supported in the case of the nickel estimates by reconciliation of nickel production by SLM during 2014.

Drillhole programs completed by SLM follow industry standard procedures for drilling, collection of samples and submission to external laboratories. Where specific gravity data is absent, regression curves have been used to populate the database. Data collection, retention and backup by SLM follow industry standards. No independent verification of significant intersections has been performed. Overall thorough QA/QC protocols are followed at Beta Hunt and the Qualified Person is satisfied that the data is reliable.

The Mineral Resource estimates set out in this news release have been prepared using accepted industry practice and classified in accordance with the JORC Code, 2012 Edition. Elizabeth Haren, MAusIMM CPGeo, of Haren Consulting Pty Ltd accepts responsibility as Qualified Person for the Mineral Resource estimates. The "JORC Code" means the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Mineral Council of Australia. There are no material differences between the definitions of Mineral Resources under the applicable definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards") and the corresponding equivalent definitions in the JORC Code for Mineral Resources.

Readers are advised that Mineral Resources not included in Mineral Reserves do not demonstrate economic viability. Mineral Resource estimates do not account for mineability, selectivity, mining loss and dilution. These Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied.

Based on the resource estimate, a standard methodology for stope design, mining sequence and cut-off grade optimization, including application of mining dilution, process recovery, economic criteria and physical mine and plant operating constraints has been followed to design the mine and to complete a Preliminary Economic Assessment ("PEA") report for the Beta-Hunt Mine by David Penswick, P.Eng.

The PEA is preliminary in nature, and is based on a mineral resource estimate that includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

Cautionary Note to U.S. Readers Regarding Estimates of Resources

This news release uses the terms "measured" and "indicated" mineral resources and "inferred" mineral resources. The Company advises U.S. investors that while these terms are recognized and required by Canadian securities administrators, they are not recognized by the SEC. The estimation of "measured" and "indicated" mineral resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. The estimation of "inferred" resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. It cannot be assumed that all or any part of a "measured", "inferred" or "indicated" mineral resource will ever be upgraded to a higher category.

Under Canadian rules, estimates of "inferred mineral resources" may not form the basis of feasibility studies, pre-feasibility studies or other economic studies, except in prescribed cases, such as in a preliminary economic assessment under certain circumstances. The SEC normally only permits issuers to report mineralization that does not constitute "reserves" as in-place tonnage and grade without reference to unit measures. Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part or all of a "measured", "indicated" or "inferred" mineral resource exists or is economically or legally mineable. Information concerning descriptions of mineralization and resources contained herein may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

Qualified Person

The disclosure of scientific and technical information contained in this news release has also been approved by Alger St-Jean, P. Geo., Vice President Exploration of RNC and Johnna Muinonen, Vice President Operations of RNC, both Qualified Persons under NI 43-101.

About Royal Nickel Corporation

Royal Nickel Corporation is a multi-asset mineral resource company focused primarily on the acquisition, exploration, evaluation and development of base metal and platinum group metal properties. RNC's principal asset is the Dumont Nickel Project strategically located in the established Abitibi mining camp, in the municipalities of Launay and Trécesson, 25 kilometres northwest of Amos, Quebec. RNC also owns interests a majority interest in the West Raglan and Qiqavik projects in northern Quebec. RNC has a strong management team and Board with over 100 years of mining experience in the nickel business at Inco and Falconbridge. RNC's common shares and warrants trade on the TSX under the symbols RNX and RNX.WT. RNC also trades on the OTCQX market under the symbol RNKLF.

About SLM

SLM is a private company based in Australian focused on developing mineral properties. Its main asset is the Beta-Hunt nickel-gold mine located in Western Australia.

Cautionary Statement Concerning Forward-Looking Statements

This news release provides certain financial measures that do not have a standardized meaning prescribed by IFRS. Readers are cautioned to review the stated footnotes regarding use of non-IFRS measures.

This news release contains "forward-looking information" including without limitation statements relating to the potential of the Beta Hunt Mine.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of RNC to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: failure of the parties to sign definitive agreements and satisfy conditions of closing; future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to RNC's filings with Canadian securities regulators available on SEDAR at www.sedar.com.

Although RNC has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and RNC disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

SOURCE Royal Nickel Corporation

Image with caption: "Figure 1: Plan view of gold targets and drill intersections outside the existing resource (Source: Beta Hunt Mine PEA dated March 4, 2016 available at www.royalnickel.com and www.sedar.com) (CNW Group/Royal Nickel Corporation)". Image available at: http://photos.newswire.ca/images/download/20160306_C4960_PHOTO_EN_636078.jpg

Straight from our desk, to your inbox.

Subscribe To Our News Releases

© All rights reserved Karora Resources 2024